Audit

3 Reasons for a Nonprofit to Conduct an Independent Financial Audit

Every nonprofit leader knows that their organization is subject to a number of regulatory compliance requirements. In many cases, this includes the need for the organization’s financial statements to undergo an audit, often on an annual basis. Checking off all the compliance-related boxes required by the local, state, or federal government is obviously important for…

Read MoreBoard Member Perspective – Questions to Ask When Reviewing an Audit

You are presented with the financial statements prepared by auditors. Do you know what questions to ask? What will the auditors tell you only if you ask? The process of auditing the financial statements of an organization is quite invasive not only on the transactions and balances that make up the financial statements, but also…

Read MoreBoard Member Perspective – Financial Information to Review

If you belong to more than one nonprofit board you may have noticed that each one may present a somewhat different set of financial information at board meetings. Do you know what is the appropriate information to present and examine? In order to comply with your fiduciary duty, you should be presented with complete, accurate,…

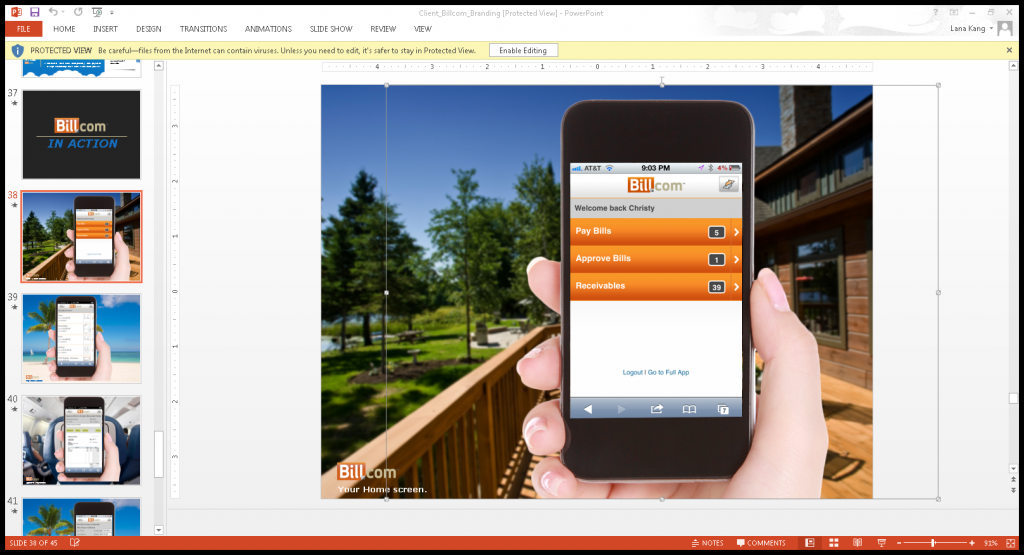

Read MoreBill.com- More Pros & Cons of Part 2 – Specifics

Bill.com is a cloud-based accounting application our firm has been using for several years. In Part 1, I covered some general pros and cons of bill.com. This blog post will delve into some of the specifics, especially with regards to the accounts payable (AP) and accounts receivable (AR) functionality of Bill.com. Like the first, keep…

Read MoreBill.com Pros & Cons – Part 1 – General Overview

What is Bill.com? – Bill.com is a cloud-based financial solution that helps manage your payables (APs) and receivables (ARs). Our firm has been using it for the past few years and has consistently found it to be an asset to our clients. Read on for an insider’s list of pros and cons (with a few…

Read MoreHappy auditors= good audit

We just finished the financial statement audit of one of our clients. The auditor, with whom we’ve worked for many years, came to see me after he finished filed work to discuss how the audit went and what to expect. I was surprised by how much he had to say about the credit card and…

Read More